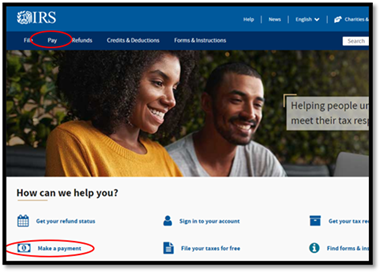

1. Go to https://www.irs.gov/

2. Select “Pay” at the top or “Make a payment” on the left.

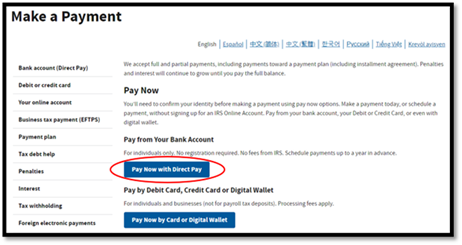

3. Select “Pay Now with Direct Pay”

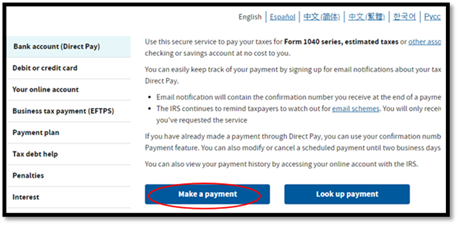

4. Select “Make a payment”

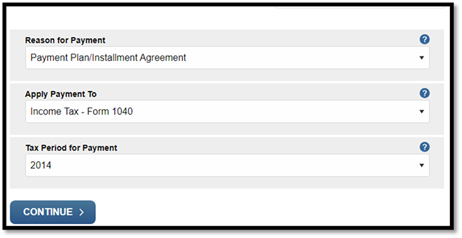

5. Fill out the “Reason”, “Apply To” and “Tax Period” *1. Hit “Continue” and again on the pop-up window that will appear.

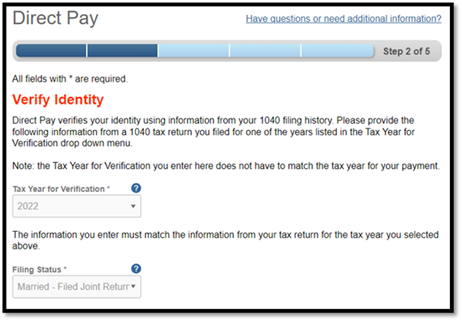

6. The next screen is to verify your identity. Questions are:

a. Tax Year for Verification

i.

Select a year in which you have the return. You should write this information down, so

you don’t have to look it up next time.

ii.

Filing Status – Whatever you filed as that

year.

iii.

First Name, Last Name, Confirm Last Name –

Make sure it’s the same as on the return you’re using for verification.

iv.

SSN or ITEN – No dashes or spaces.

v.

Complete Date of Birth and the address on

return.

7.

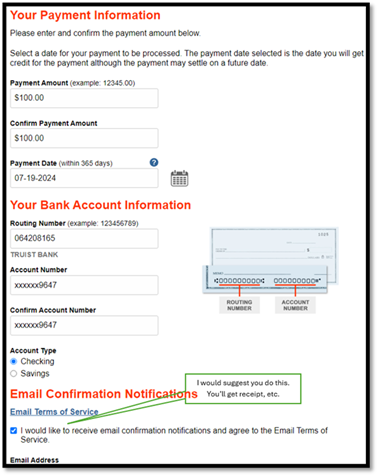

Fill out payment information. Suggestion: Select the Email

Confirmation Notifications

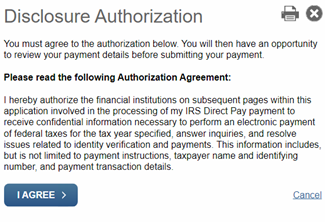

8. Click “I Agree” on the pop-up disclosure agreement

9.

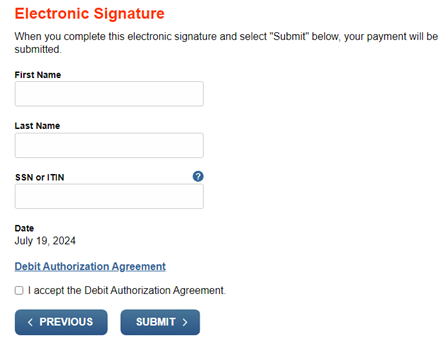

Finally, complete the “Electronic Signature”

This is the final step. Clicking “Submit”

sends the payment.

*1 Tax

Period for Payment

The Tax Period for Payment should be the tax period for which

you are making a payment.

If your payment is for an installment agreement for multiple

years you should usually choose the earliest tax year. If you are unsure which

year to choose, check the payment reminder notice you received.

If you are making a payment for more than one tax year that

is not associated with an installment agreement, you should enter and submit

the payments for each tax year separately.